- Ceramics Industry

-

FUEL PRICE EVOLUTION IN SPAIN 1981-2015

|

|

World pet coke production is growing faster than demand for it.

|

Energy costs are undoubtedly one of the most significant variables and concerns in the ceramics industry as, depending on the country, the time and the energy consumption in each case, energy represents between 20 and 50% of production costs.

For this reason, and also thanks to the availability of modern combustion technologies, several hundred ceramics plants all around the world have replaced a large part of their natural gas and fuel oil consumption with low-cost solid fuels, above all pet coke.

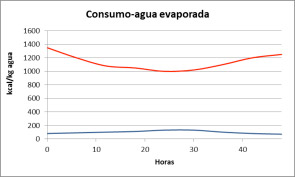

Energy costs vary significantly in each country, but if you take the case of Spain as a reference, you find that pet coke and natural gas prices in 1981, converted into euros, were €75 per ton of pet coke and €130 per 1,000 m3 of natural gas.

Applying the Spanish National Statistics Institute’s web-based price updating tool, according to inflation in Spain over the 34 years from 1981 to 2015, you can get the equivalent price of these 1981 fuels today and can compare them with actual current prices.

|

1981 Prices in Spain (1) |

1981 Updated to 2015 (2) |

Current Prices – June 2015 (3) |

|

(in pesetas) |

(in EUR) |

Pet Coke (T) |

12,500 ESP |

€75 |

€336 |

€130 |

Natural Gas (1.000 m3) |

21,700 ESP |

€130 |

€587 |

€330 |

This interesting exercise leads us to two conclusions:

- Energy was relatively much more expensive in 1981 than it is today.

- Pet coke has come down in price much more than gas: while natural gas costs 56% of what it should have cost if its price had evolved at the same rate as price increases over the last 34 years in Spain, pet coke only costs 39% with respect to its 1981 price.

The main reason for the relative drop in the price of pet coke is the increase in its production. Consumption of it worldwide increases annually, but production increases even more, as the new oil refining technologies give it as a final waste, unlike older refining technologies that gave fuel oil. As oil refineries around the world update their technologies, pet coke production increases and fuel oil production falls, which explains the significant rise in the price of the latter liquid fuel over recent years.

Many clients and friends around the world, doubting whether to opt for pet coke consumption, raise with BERALMAR their fear that pet coke may see price rises like those that have affected other fuels. To be honest, we can say no more than we do not know the future and there are no crystal balls. We can, though, recommend that they look at and take into account the behaviour of pet coke prices over the last 34 years in Spain and in the world in general, which makes you think that investing in solid fuels for firing is apparently a pretty good bet.

Sources:

(1) BERALMAR’s files.

(2) Spanish National Statistics Institute (INE). www.ine.es

(3) García-Munté Energía S.L. and several Spanish ceramics plants. Price including transport to factory.

|